Want to Make Extra Money Now?

|

Personal loans can finance a variety of family expenses, such as home improvement projects, weddings, vacations and even land purchases. They're also used for debt consolidation because interest rates are lower than credit cards—especially for those with good to excellent credit scores.

Personal loans from traditional banks, credit unions, and internet lending firms make it simple to fill out an application online—without having to go to a bank branch. Furthermore, many personal loans can be funded in a few business days, so you won't have to wait long to receive the cash you need. Low interest rates for well-qualified borrowers, wide range of loan sizes and terms, and minimal costs are all features that distinguish great personal loans.

Compare Personal Loan Rates

What is a personal loan?

A personal loan is a type of unsecured loan that can be used for a variety of purposes, from consolidating debt to financing a large purchase. Personal loans typically have lower interest rates than credit cards, making them a good option for borrowers who need to borrow money at a relatively low cost.

You can repay personal loans either in monthly installments or all at once (known as a lump sum payment). The repayment term for personal loans is usually between two and five years, although some lenders may offer terms as long as seven years.

Personal loan interest rates and fees

Personal loan interest rates vary depending on the lender, but they are typically lower than the interest rates on credit cards. Personal loan fees also vary by lender, but they are typically much lower than the fees charged for things like cash advances or balance transfers.

Borrowers with excellent credit ratings typically pay rates ranging from 11% to 15%, while those with bad credit may be charged a rate of up to 25%.

Here’s what interest rates on personal loans look like, on average:

| How's your credit? | Score range | Estimated APR |

|---|---|---|

| Excellent | 720-850. | 10.8%. |

| Good | 690-719. | 14.4%. |

| Fair | 630-689. | 19.4%. |

| Bad | 300-629. | 25.2%. |

When should I get a personal loan?

There are a few situations in which taking out a personal loan may be a good idea.

If you have high-interest debt, such as credit card debt, you can use a personal loan to consolidate that debt into one monthly payment at a lower interest rate. This can save you money over time and help you get out of debt faster.

If you need to make a large purchase, such as a car or home repairs, and you don't have the cash on hand, a personal loan can give you the funds you need. Personal loans can also be used for things like wedding expenses or medical bills.

Personal loans become part of everyone’s life at one point or another and nowadays, direct lenders are on every page of the internet offering you the best deals.

But it’s for good reason.

A personal loan could be used to:

There are some types of personal loans that gained more popularity than others due to their several benefits, but this doesn’t mean they’re right for you. It can be tough to know where to start and what types of loans you can find on the market and which ones better suit your needs.

Fortunately, a personal loan from a reputable lender can be a low-cost solution when you need to borrow money.

Keep reading for more information about whether a personal loan is right for you.

Take Control of Your Finances Now

Whether you’re consolidating debt, making a home improvement, or anything in between,

apply now to get the best personal loan interest rates and terms available.

Pros and cons of personal loans

There are a few things to consider before taking out a personal loan, both the good and the bad.

The biggest pro of taking out a personal loan is that it can save you money. If you have high-interest debt, consolidating that debt into a personal loan with a lower interest rate can help you save money on interest over time. Personal loans can also help you avoid things like late fees and penalties, which can add up quickly.

The biggest con of taking out a personal loan is that you may end up paying more in interest and fees than you would with other types of loans. Personal loans typically have higher interest rates than other types of loans, such as home equity loans or car loans. And if you miss a payment or default on your loan, you may be charged additional fees.

Before taking out a personal loan, make sure you understand the terms and conditions. Be sure to shop around and compare offers from multiple lenders to find the best rates and fees. And always make sure you can afford the monthly payments before taking out a loan.

How to choose the best personal loan

There are a few things to consider when shopping for a personal loan, including the interest rate, fees, repayment term, and whether the loan is unsecured or secured.

The interest rate is one of the most important factors to consider when shopping for a personal loan. The lower the interest rate, the less you will pay in interest over time. Be sure to compare rates from multiple lenders to find the best deal.

Fees can also add up quickly with a personal loan, so be sure to compare offers from multiple lenders to find the lowest fees. Some lenders may charge origination fees, prepayment penalties, or late payment fees.

The repayment term is another important factor to consider when shopping for a personal loan. The longer the repayment term, the lower your monthly payments will be but the more interest you will pay over time. Be sure to choose a repayment term that you can afford.

Finally, personal loans can be either unsecured or secured. Unsecured personal loans are not backed by collateral, so they typically have higher interest rates than secured loans. Secured loans are backed by collateral, such as a car or home, so they typically have lower interest rates.

The bottom line

Personal loans can be a great way to consolidate debt, make a large purchase, or cover unexpected expenses. But before taking out a loan, be sure to understand the terms and conditions and compare offers from multiple lenders. And always make sure you can afford the monthly payments before taking out a loan.

Need cash now?

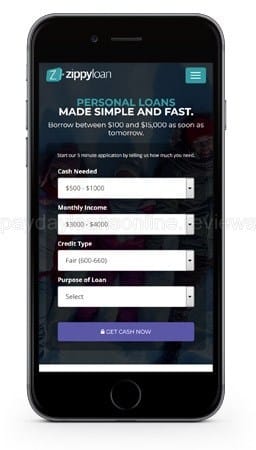

If you actually need money now, then you can opt for a personal loan. When you need money in a hurry ZippyLoan is where to go.

You apply for a loan through the ZippyLoan site, if approved they send your loan application to one of many loan providers.

You review the loan details and e-sign if you like what you see. No risk in checking what offers you'll get.

You can borrow between $100 and $15,000 as soon as tomorrow.

Loans service for up to 60 months. ZippyLoan connects borrowers to lenders through their network of lenders. They'll find you the lowest interest rate and is one of the best no credit check loan. You can visit ZippyLoan here.

Want to Make Extra Money Now?

|